Contact Us:

Tax-Free Retirement Planning

How it Works

How The Tax-Free Retirement Planning Works

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Schedule a Discovery Call

During this no-obligation session, we’ll discuss your goals, answer your questions, and explore how our personalized strategies—whether for estate planning, tax-free retirement, or life insurance—can help protect what matters most. It's a simple, pressure-free conversation designed to give you clarity and confidence about your next steps.

Analyze Your Financial Snap Shot

We gather and review essential information—income, assets, liabilities, insurance coverage, and current retirement plans. This allows us to identify gaps, tax exposure, and opportunities to reposition assets for tax-free growth.

Customized

Retirement Plan

Using insights from your financial snapshot, we design a personalized plan leveraging vehicles like Indexed Universal Life (IUL) insurance or Roth conversion strategies that offer tax-free income, growth, and protection.

Implement the Plan

Once you're comfortable with the strategy, we help execute the plan—this may include funding a life insurance policy, adjusting asset allocations, or setting up trusts and beneficiary designations. Every step is guided and supported.

Perform an Annual Review

Your life and financial goals may evolve, so we schedule yearly reviews to ensure your plan stays aligned with your objectives, remains tax-efficient, and continues to grow toward your retirement vision.

Tax-Free Retirement Planning

At Paladin Financial Estate & Income Planning, we design tax-free retirement plans that let you grow wealth today and spend it tomorrow—without giving a large share to the IRS. By combining Indexed Universal Life (IUL) insurance with smart conversions and tax diversification, you can build predictable income, protect your legacy, and enjoy true financial freedom.

Protect Your Wealth and Gain Flexibility with IUL—Beyond What a 401(k) Can Offer

While a 401(k) tied to the S&P 500 offers market-based growth potential, it also exposes your retirement savings to full market volatility, taxes on withdrawals, early withdrawal penalties, and rigid distribution rules. In contrast, an Indexed Universal Life (IUL) insurance policy provides the opportunity for tax-deferred growth with a floor that protects against market losses and a cap that limits gains. More importantly, IULs allow for tax-free income through policy loans, have no required minimum distributions, and offer death benefit protection for your loved ones. With an IUL, you gain long-term financial security, tax efficiency, and the flexibility to access your money on your terms.

How the IRS Lets IUL Deliver Tax-Free Income

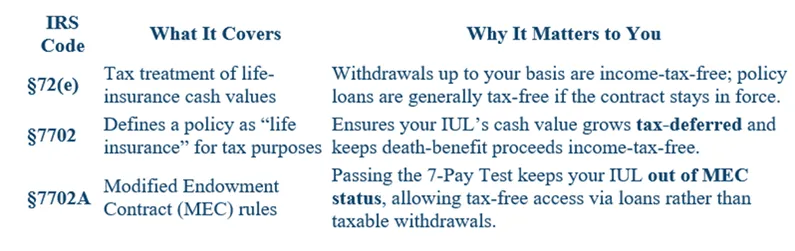

Leverage IRS-Approved Strategies §72(e) | §7702 | §7702

Because properly structured IUL policies satisfy all three sections, you can access your accumulated cash value with tax-free policy loans, creating a flexible income stream in retirement while maintaining a valuable death benefit for your heirs.

Core Tax-Free Retirement Strategies

1. Indexed Universal Life (IUL)

Tax-free policy loans backed by §§72(e), 7702, 7702A

Downside protection with index-linked growth potential

Built-in life insurance to safeguard your family

Who Benefits Most?

High-income earners seeking to cap future tax exposure

Business owners wanting flexible, creditor-protected cash access

Pre-retirees diversifying away from fully taxable 401(k)/IRA balances

Families looking to pass on a larger, tax-efficient legacy

Disclaimer: Paladin Financial Estate & Income Planning does not provide tax or legal advice. Consult your professional tax advisor regarding your specific situation.

Start Your Tax-Free Retirement

Journey Today

Begin your tax‑free retirement planning journey today to lock in more control over your future income and safeguard your hard‑earned savings from unpredictable tax hikes.

By taking action now—rather than waiting until you’re closer to retirement—you give your money extra time to grow in tax‑advantaged vehicles such as Indexed Universal Life (IUL) insurance and Roth accounts, while also diversifying income sources for added stability.

Early planning lets you capitalize on compounding, adjust contributions as your goals evolve, and position yourself to enjoy a predictable, worry‑free retirement where more of every dollar you earn stays in your pocket and passes efficiently to your loved ones.

Your Goals Are Unique—Your Strategy Should Be Too

We go beyond products to design an integrated, tax‑efficient, protection and growth strategy tailored to your family’s priorities,

from wealth accumulation to estate and income planning, we unify every piece so your financial life works in sync.